Fresh uptrend rally possible above 65,230

On Tuesday, the benchmark indices witnessed range-bound price action as NSE Nifty ends 37 points higher, while BSE Sensex was up by 79 points. Among sectors, Reality and Metal indices rallied over one per cent whereas PSU bank stocks and selective FMCG stocks witnessed intraday profit booking at higher levels.

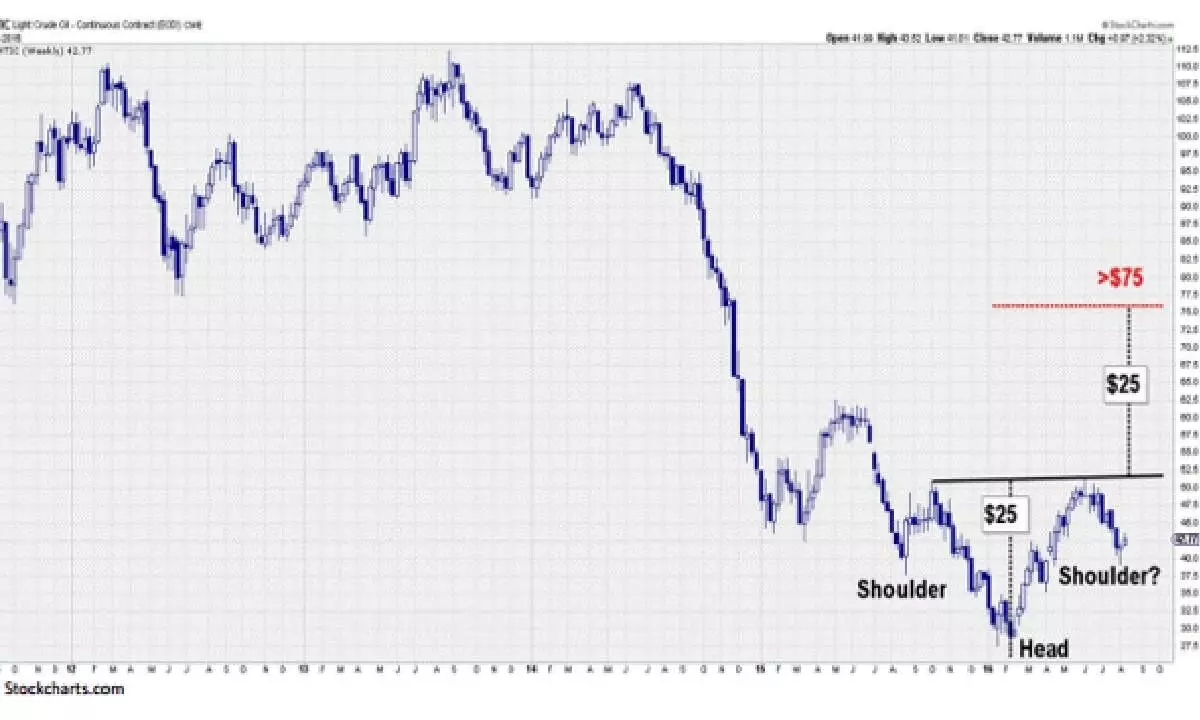

image for illustrative purpose

Mumbai On Tuesday, the benchmark indices witnessed range-bound price action as NSE Nifty ends 37 points higher, while BSE Sensex was up by 79 points. Among sectors, Reality and Metal indices rallied over one per cent whereas PSU bank stocks and selective FMCG stocks witnessed intraday profit booking at higher levels.

“Technically, currently the market is witnessing positive consolidation near 50-day SMA (Simple Moving Average) for the bulls now fresh uptrend rally possible only after dismissal of 65,230,” says Shrikant Chouhan of Kotak Securities. Above which, the index could rally till 65,500-65,650. On the flip side, below 64,800 the sentiment could change. Below which, the market could slip till 64,600-64,500.

For instance, the chemical sector emerged as a clear winner due to improvements in product prices stemming from stability in the demand and supply scenario. Meanwhile, the metals sector rallied in anticipation of further green shoots from the Chinese government and central banks, aimed at improving the local economy. The benefits from festival demand were evident in sectors such as consumer durables, manufacturing, power, and real estate. Meanwhile, the metals sector rallied in anticipation of further green shoots from the Chinese government and central banks, aimed at improving the local economy. The benefits from festival demand were evident in sectors such as consumer durables, manufacturing, power, and real estate, Chouhan said.